OCUSD (USDT Yield Vault)

Overview

The USDT Vault is a passive yield product by Solen Finance on EDUChain. Users deposit USDT and receive OCUSD, a yield-bearing stablecoin that appreciates over time based on real stablecoin yield strategies. All operations are handled by the Solen team, and users earn without needing to manage strategies themselves.

How It Works

-

Deposit USDT on EDUChain

- Users deposit USDT into the vault via the Solen frontend.

- In return, they receive OCUSD, a token that represents their share in the vault.

-

Yield Strategies Managed by Solen

- Solen deploys the USDT into stablecoin yield strategies on Arbitrum One.

- Yield is harvested and bridged back to EDUChain to grow OCUSD value.

-

Automatic Yield Accrual

- OCUSD is non-rebasing and increases in value over time.

- No need to stake or claim — holding OCUSD is enough.

-

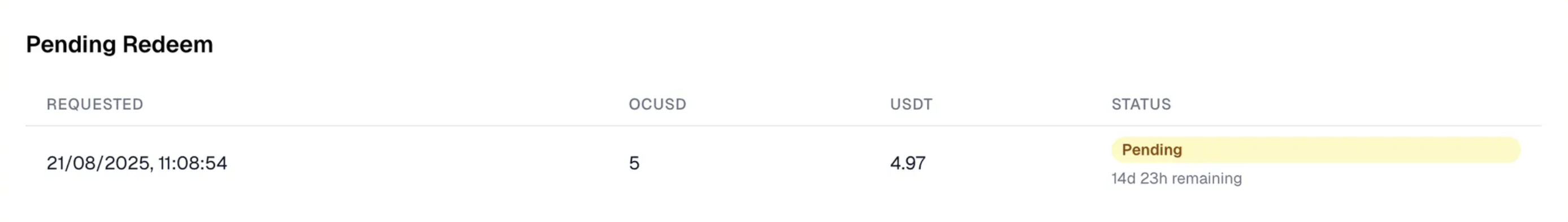

Redemption Process

- Users initiate a cooldown via clicking the “Redeem” button.

- After the cooldown period (default 15 days), they can claim USDT on EDUChain.

Key Vault Parameters

| Parameter | Value |

|---|---|

| Vault Token | OCUSD |

| Deposit Asset | USDT |

| Yield Source | Stablecoin strategies on Arbitrum One |

| Strategy Manager | Solen Finance |

| Cooldown Period | default 15 days (epoch-based) |

| Minting Fee | 0% |

| Redemption Fee | 0.6% |

| Redemption Location | EDUChain only |

| Contract Address | 0x3C886065abf6E489071D0149b63d8EfD96906a7c |

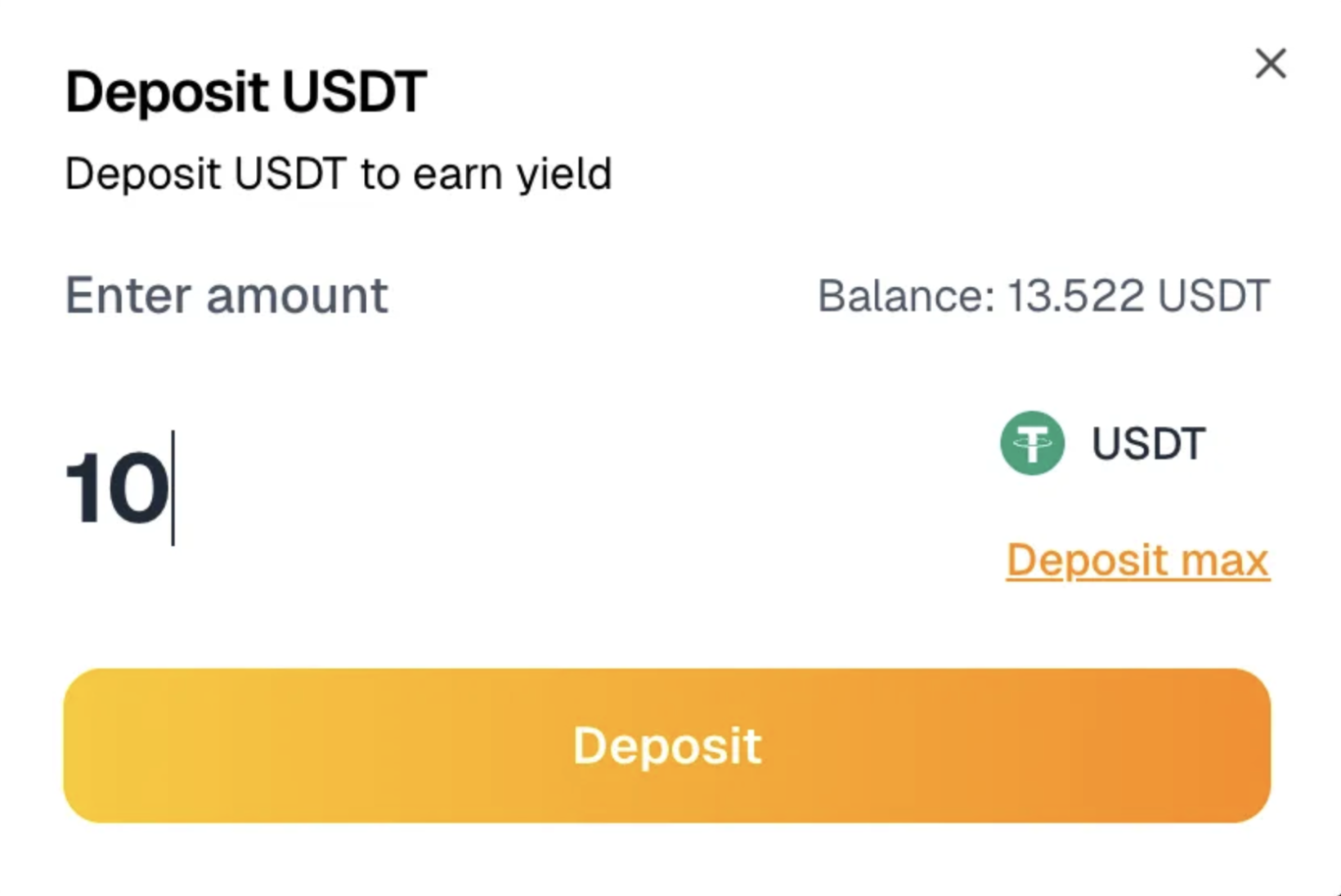

Deposit Flow (Users)

- Step 1: Deposit USDT via the Solen frontend.

- Step 2: Receive OCUSD at current share price, minus any mint fee.

- Step 3: Start earning passive yield.

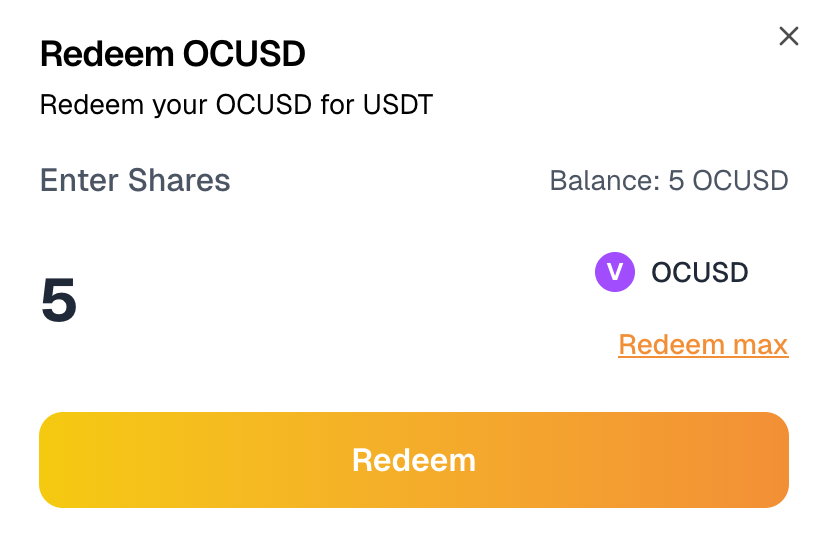

Redemption Flow (Users)

- Step 1: Click the “Redeem” button to initiate the redeem process.

- Step 2: Wait for cooldown period (default 15 days).

-

Step 2.5: In this time, you can’t request another redeem.

-

Step 3: Call

claim()to receive USDT on EDUChain. -

Redemption Fee: 0.6% of withdrawn amount.

Risks

All vaults carry inherent risks. Key risks include:

- Smart Contract Risk: Bugs or exploits in Solen or third-party contracts.

- Multisig Risk: Assets are managed via a Solen-controlled multisig.

- Strategy Risk: Involves exposure to third-party protocols with potential for depeg, slippage, or insolvency.

Solen’s contracts have been audited, but audits do not eliminate all risk.

Audit Report from Certik is here:

https://skynet.certik.com/projects/solen-finance